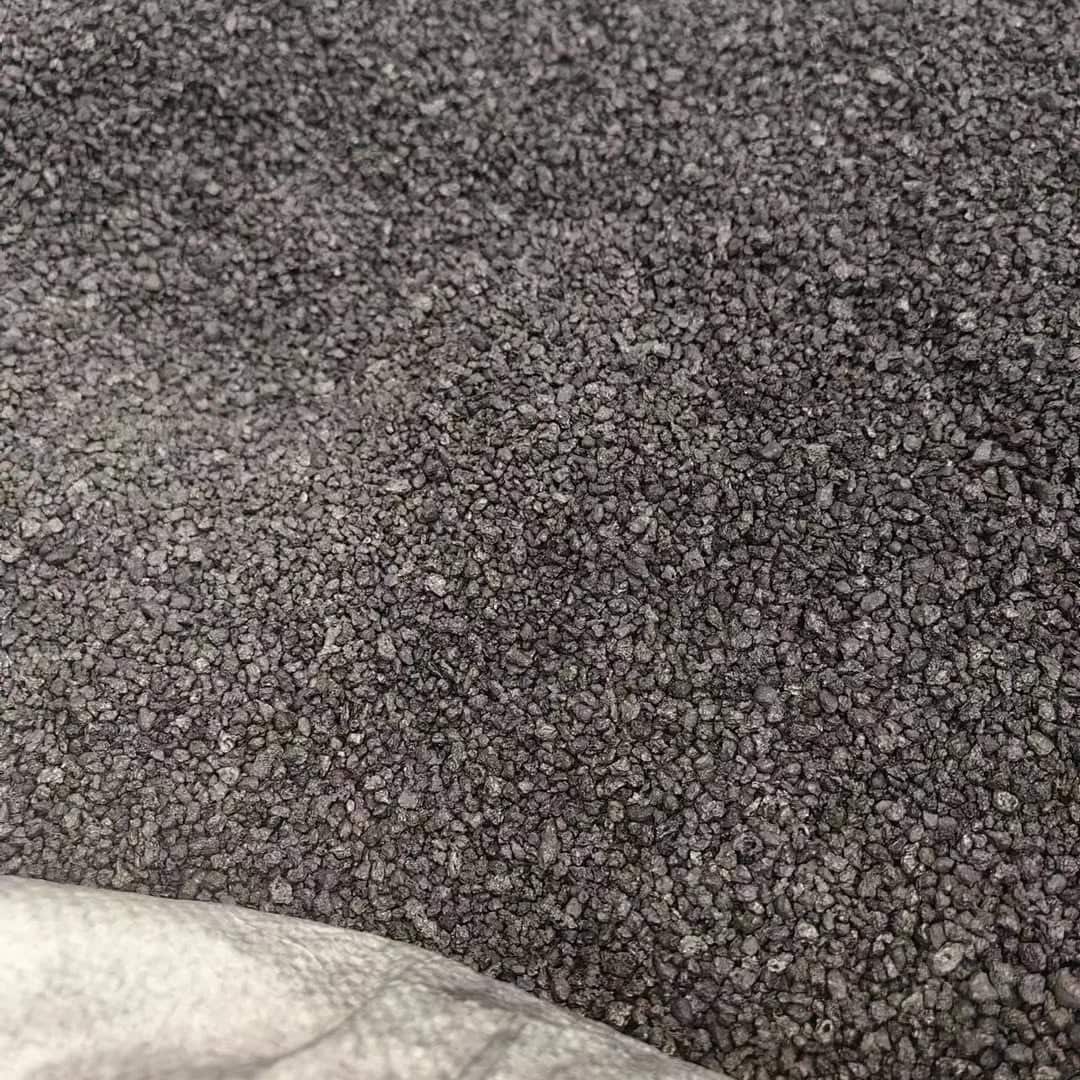

Premium Graphitized Petroleum Coke (GPC) – Price 2026

In 2026, the Graphitized Petroleum Coke (GPC) price range is structurally driven by energy‑intensive graphitization costs, feedstock purity, and sulfur reduction efficiency, rather than speculative or short‑term market fluctuations

As GPC requires thermal treatment exceeding 2,500°C, electricity pricing and furnace utilization rates remain the dominant cost contributors influencing market values

Based on observed international trade references in early 2026, metallurgical‑grade GPC prices typically fall within the range of USD 820–1,480 per metric ton, depending on fixed carbon level (≥99.0–99.5%), sulfur content (≤0.02–0.05%), and particle size distribution (fines vs. 1–5 mm granular). Premium low‑sulfur and high‑carbon grades command a measurable price spread due to improved carbon recovery, reduced slag formation, and tighter chemical control in steelmaking and foundry operations

Regional price differentiation particularly between China, Eurasian production hubs, and alternative suppliers reflects disparities in electricity tariffs, environmental compliance costs, and production yields, positioning technical specifications as the primary determinant of GPC price formation in 2026, rather than origin labeling alone

This content is provided for technical and market reference purposes only and does not represent a sales offer, quotation, or forward price forecast

| GPC Grade (Technical) | Fixed Carbon (%) | Sulfur (%) | Size (mm) | Delivery Term | Indicative Price Range (USD/MT) |

|---|---|---|---|---|---|

| GPC – Standard | ≥ 99.0 | ≤ 0.05 | 1–5 | EXW Iran | 820 – 950 |

| GPC – Low Sulfur | ≥ 99.2 | ≤ 0.03 | 1–5 | EXW Iran | 920 – 1,080 |

| GPC – Premium | ≥ 99.5 | ≤ 0.02 | 1–5 | FOB China (Xingang) | 1,150 – 1,350 |

| GPC – High Purity | ≥ 99.7 | ≤ 0.02 | 1–5 | FOB China (Xingang) | 1,300 – 1,480 |

| GPC – Fine Fraction | ≥ 99.0 | ≤ 0.05 | 0–1 | Regional Supply | 850 – 1,050 |

| GPC – Coarse Fraction | ≥ 99.0 | ≤ 0.05 | 5–10 | Regional Supply | 800 – 980 |

:GPC Price Structure in 2026: Technical Cost Drivers

In 2026, GPC price formation is primarily driven by graphitization energy intensity, feedstock purity, and sulfur reduction efficiency, rather than short‑term market sentiment. Electricity cost per ton, furnace operating stability above 2,500 °C, and yield loss during high‑temperature treatment represent the dominant structural cost components

Variations in fixed carbon level, residual sulfur, and particle size distribution further segment the market into distinct technical price bands, making specification compliance the key determinant of GPC pricing behavior in 2026

:Energy and Graphitization Impact on GPC Pricing

The cost structure of graphitized petroleum coke is dominated by the energy intensity of the graphitization process, which requires sustained temperatures above 2,500 °C

Electricity tariffs, furnace efficiency, and cycle duration directly influence conversion yield and unit cost. Producers operating in regions with stable power supply and optimized thermal control achieve lower defect rates and tighter carbon structure, resulting in measurable price differentiation across GPC grades

:How Sulfur and Fixed Carbon Define GPC Price Bands

Price segmentation in graphitized petroleum coke is strongly correlated with the balance between fixed carbon concentration and residual sulfur content

GPC with higher fixed carbon levels (≥ 99.5%) offers improved carbon recovery and process stability, while lower sulfur thresholds (≤ 0.03–0.02%) reduce slag volume and minimize downstream metallurgical penalties. As sulfur removal efficiency declines sharply at ultra‑low levels, each incremental reduction introduces disproportionate processing cost, creating distinct and predictable GPC price bands

:Particle Size Distribution and Its Effect on Market Value

In graphitized petroleum coke, particle size distribution is not merely a physical parameter but a direct driver of market value

Finer and narrowly controlled PSDs enable faster dissolution, higher carbon recovery, and more predictable process behavior, while inconsistent sizing introduces yield loss and operational inefficiencies

As tighter size tolerances require additional screening, handling, and material losses, well‑graded GPC commands a measurable price premium independent of chemical composition

:Regional Price Variations: China and Eurasian Supply

Regional GPC price differentials in 2026 are largely shaped by electricity cost structures, environmental compliance intensity, and production scale efficiency rather than basic material specifications

Chinese supply benefits from integrated graphitization capacity and logistics density, while Eurasian producers often compete through lower energy tariffs and flexible feedstock sourcing. As a result, overlapping price ranges between regions reflect cost‑structure trade‑offs, not quality parity, reinforcing the need to evaluate GPC pricing within its regional production context

:Interpreting Indicative GPC Prices: Technical vs Commercial Data

Indicative GPC prices are analytical benchmarks derived from observed trade ranges and technical specifications, intended to explain cost behavior rather than define transaction value

Unlike commercial pricing which reflects volume, payment terms, credit risk, logistics, and timing technical price references isolate variables such as energy intensity, sulfur thresholds, and particle size control. Understanding this distinction is essential to avoid misinterpreting reference price bands as executable market offers

| Dimension | Indicative (Technical) GPC Price | Commercial GPC Price |

|---|---|---|

| Primary Purpose | Cost structure analysis and market understanding | Executable transaction value |

| Source of Data | Observed trade ranges, COA parameters, energy input | Negotiated deals between buyer and seller |

| Key Variables Considered | Fixed carbon, sulfur level, PSD, graphitization energy | Volume, payment terms, credit risk, logistics |

| Price Expression | Range (USD/MT) | Single agreed figure |

| Time Sensitivity | Medium (reflects market phase) | High (deal‑specific timing) |

| Commercial Intent | None (reference only) | Explicit |

| Use in Market Analysis | Benchmarking and cost comparison | Contract execution |

:Frequently Asked Questions

?What is Graphitized Petroleum Coke (GPC

Graphitized Petroleum Coke is a high‑purity carbon material produced by graphitizing petroleum coke at temperatures typically above 2,500°C, resulting in very high fixed carbon content and low impurity levels

?How does GPC differ from regular petroleum coke

Unlike regular petroleum coke, GPC undergoes an additional high‑temperature graphitization process, which significantly reduces sulfur and volatile matter while improving crystalline carbon structure and electrical conductivity

?Why is low sulfur important in GPC

Low sulfur levels (typically ≤ 0.05%) are critical in steel and foundry applications to prevent sulfur pickup in molten metal, which can adversely affect mechanical properties and downstream processing.

?What role does particle size play in GPC performance

Particle size distribution (PSD) determines dissolution speed and carbon recovery efficiency. Smaller sizes dissolve faster but may increase dust losses, while controlled ranges such as 1–5 mm offer balanced kinetics for ladle and furnace additions

?Is GPC used as a carbon raiser in steelmaking

Yes. GPC is widely used as a carbon raiser due to its high fixed carbon content, low sulfur, and predictable absorption behavior in molten steel and cast iron

?Does this page provide commercial prices for GPC

No. Any price references shown are indicative, technical benchmarks derived from observed trade data and cost factors. They are included solely for market understanding and do not represent commercial offers or transaction terms

?What technical parameters most influence GPC price ranges

From a technical perspective, the most influential parameters are fixed carbon percentage, sulfur content, ash level, and particle size control. Commercial factors such as payment terms or logistics are excluded from technical price interpretation

?Can technical COA data be used as a purchase specification

COA data serves as a reference benchmark for quality evaluation but should not be treated as a contractual specification without independent validation and alignment with formal purchase agreements

:Conclusion

Graphitized Petroleum Coke (GPC) is a critical high‑purity carbon material whose industrial value is defined by controlled graphitization, high fixed carbon content, low sulfur levels, and predictable particle size distribution

When evaluated correctly, these technical parameters explain performance behavior in steelmaking and foundry applications without relying on transaction‑specific assumptions

Throughout this page, GPC has been presented as a technical reference material, with chemical analysis, process characteristics, and indicative market observations clearly separated from commercial execution

Any price‑related data discussed reflects observed industry ranges and underlying cost drivers, serving strictly as contextual insight rather than executable market quotations

A disciplined distinction between technical reference data and commercial pricing is essential for accurate market interpretation, risk management, and compliance within the global carbon and ferroalloy supply chain

This approach ensures clarity for engineers, analysts, and decision‑makers seeking reliable, specification‑driven understanding of GPC in an evolving international market

Phone: +989121684359

WhatsApp: +989121684359

For more information, visit our website: Ferrosilicon.co 🌐